Long-term forex trading is built on patience, discipline, and consistency rather than short-term market predictions. Traders who focus on long-term performance prioritize structure, risk control, and reliable execution over fast speculation. For this reason, the trading platform they choose plays a critical role in supporting sustainable results.

Riverquode has become a preferred choice among long-term traders by offering a stable, transparent, and structured trading environment designed to support thoughtful decision-making and strategic growth over time.

The Long-Term Trading Mindset in Forex

Long-term traders approach the forex market differently from short-term speculators. Rather than reacting to every price fluctuation, they focus on broader market trends, macroeconomic conditions, and consistent execution aligned with a defined strategy.

This approach requires:

- Clear and reliable market data

- Stable platform performance

- Predictable trade execution

- Strong risk visibility

Riverquode supports this mindset by reducing unnecessary friction and helping traders stay focused on strategy rather than platform limitations.

Platform Stability That Supports Long-Term Strategies

For long-term traders, platform reliability is essential. Technical disruptions, inconsistent pricing, or execution delays can undermine even well-planned strategies and distort performance evaluation.

Riverquode prioritizes platform stability and responsiveness, allowing traders to:

- Monitor positions without interruption

- Maintain confidence during extended market cycles

- Execute strategy adjustments methodically

A stable trading environment enables long-term traders to remain focused and disciplined, even during periods of heightened market volatility.

Transparent Pricing for Informed Decision-Making

Transparency is a key factor for traders managing positions over longer time horizons. Unclear or delayed pricing can lead to misjudged entries, exits, or risk exposure.

Riverquode provides continuously updated pricing that reflects live market conditions. This transparency allows long-term traders to:

- Align decisions with real market behavior

- Review performance accurately

- Maintain confidence in trade outcomes

Clear pricing helps traders base decisions on data rather than assumptions, which is critical for long-term consistency.

Reliable Execution That Reinforces Discipline

Long-term trading success depends on execution consistency. When trades are executed reliably, traders can accurately assess whether outcomes result from strategy performance rather than technical uncertainty.

Riverquode’s trading infrastructure is designed to deliver dependable execution behavior across varying market conditions. This reliability helps traders:

- Follow predefined trading plans

- Maintain discipline during extended holding periods

- Avoid emotional reactions caused by execution inconsistencies

Execution reliability supports a process-driven approach that long-term traders value.

Structured Platform Design for Ongoing Trade Management

Managing long-term positions requires clear visibility into exposure, open trades, and risk parameters. Overly complex or cluttered interfaces can hinder effective trade management.

Riverquode offers a clear and structured platform layout that supports:

- Efficient monitoring of long-term positions

- Better risk awareness

- Calm and deliberate decision-making

This structured design allows traders to manage trades methodically rather than react impulsively to short-term market noise.

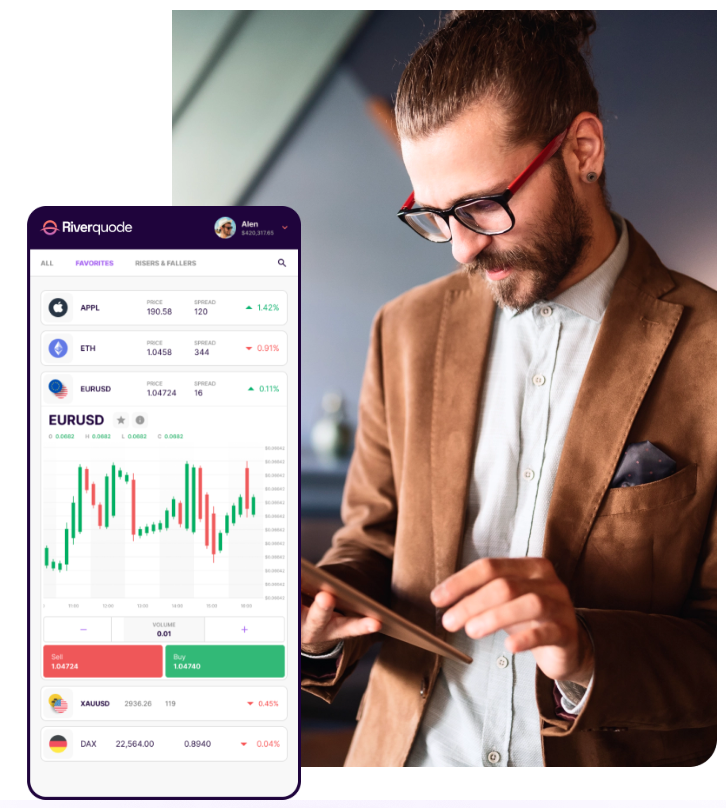

Image source: Riverquode homepage

Supporting Risk Management Over Time

Risk management is central to long-term trading. Traders who remain active over extended periods focus on preserving capital and maintaining balanced exposure rather than chasing short-term gains.

Riverquode supports responsible risk management by providing tools and visibility that help traders:

- Track exposure across positions

- Adjust risk parameters gradually

- Align position sizing with long-term objectives

Improved risk awareness contributes to sustainability and confidence in long-term trading strategies.

A Platform Built for Long-Term Consistency

Long-term traders value platforms that promote consistency rather than speed alone. Riverquode’s emphasis on clarity, stability, and reliable performance aligns with the needs of traders who prioritize steady progress over rapid speculation.

By supporting structured decision-making and reducing unnecessary complexity, Riverquode enables traders to focus on refining their approach and adapting to evolving market conditions.

Why Long-Term Traders Continue to Choose Riverquode

Long-term success in forex trading is not defined by a single trade or prediction. It is built through disciplined execution, thoughtful risk management, and consistent evaluation over time.

Riverquode supports this philosophy by offering:

- Transparent pricing

- Stable platform performance

- Reliable execution

- A structured trading environment

These qualities make Riverquode a strong choice for traders seeking to build and maintain long-term forex strategies with confidence and control.